What Does a Riskometer in a Mutual Fund Mean?

Investing is a critical aspect of wealth creation and financial planning. However, with the potential for returns comes a certain degree of risk. Understanding and managing this risk is paramount to achieving financial goals. In the world of mutual funds, the Securities and Exchange Board of India (SEBI) has introduced various tools and indicators to assist investors in making informed decisions. One such tool is the “Riskometer.” In this comprehensive guide, we will delve into the intricacies of the Riskometer, exploring its definition, historical evolution, risk levels, types of risks measured, and how investors can leverage it for informed decision-making.

Also Read: How & Why to Update the FASTag KYC? (Complete Process Explained)

Contents

What is a Riskometer?

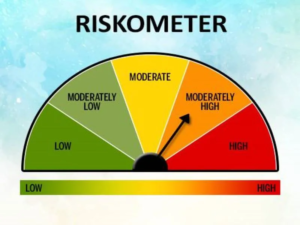

The Riskometer is a visual tool designed by SEBI to help investors assess the level of risk associated with a mutual fund. Acting as a standardized and simple gauge, it aids in understanding the potential risk profile of a specific mutual fund. Displaying six risk levels on a scale, the Riskometer enables investors to make informed decisions based on their risk tolerance and investment objectives.

History of Riskometer:

Introduced in 2013 by SEBI, the Riskometer underwent two significant amendments in 2015 and 2020. The Association of Mutual Funds in India (AMFI) established clear rules for ranking funds in different risk levels. Evolving from a three-color classification system to the current six-level scale, the Riskometer has become more accurate and informative in assessing mutual fund risks. Shaped like a car speedometer, it offers a quick and intuitive way to comprehend the risk associated with different funds.

Riskometer Risk Levels and Descriptions:

The Riskometer displays risk levels through distinct colors, each associated with a specific description:

| Risk Level | Color | Description |

|---|---|---|

| Low | Light Green | Very low risk; stable returns over the long term. |

| Low to Moderate | Green | Low risk; moderate returns over the long term. |

| Moderate | Yellow | Moderate risk; balanced returns over the long term. |

| Moderately High | Orange | High risk; high returns with a greater chance of loss. |

| High | Red | Quite high risk; very high returns with a very high chance of loss. |

| Very High | Maroon | Very high risk; suitable for investors with a long-term investment vision. |

Types of Risks Measured by Riskometer:

The Riskometer assesses various types of risks associated with different mutual fund categories:

- Equity Funds: Moderately high to very high risk due to exposure to the stock market.

- Debt Funds: Lower risk compared to equity funds, but risk varies based on the type of debt instruments.

- Hybrid Funds: Moderate risk due to a blend of equity and debt components.

- Sectoral Funds: Can have a very high-risk profile due to concentrated exposure to specific sectors.

- Liquid Funds: Typically low-risk due to investments in short-term debt instruments.

- Other Risks: Rebalance risk, Currency risk, Concentration risk, Inflation risk, Volatility risk.

Factors to Consider Besides Riskometer:

While the Riskometer is a valuable tool, investors should consider additional factors:

- Expense Ratio: The cost of managing the fund.

- Performance Against Benchmark: How the fund performs compared to a benchmark.

- Fund Manager Experience: The track record and expertise of the fund manager.

- Investment Objectives: Aligning fund characteristics with personal investment goals.

How to Use Riskometer for Investing?

Investors can use the Riskometer to tailor their investments to their risk appetite:

Conservative Investors:

Opt for low to moderately low-risk products, prioritizing capital preservation.

Moderate Investors:

Comfortable with moderate-risk products offering a balance between appreciation and stability.

Aggressive Investors:

Willing to take on high or very high-risk products for potentially higher returns, understanding the associated volatility.

In conclusion, the Riskometer is a crucial tool for investors to gauge and understand the risk levels associated with mutual funds. By considering the Riskometer alongside other key factors, investors can make well-informed decisions aligned with their financial goals and risk tolerance.