How to Buy Sovereign Gold Bonds (SGBs) Online in Groww: A Step by Step Guide

Diving into the world of investments brings us to a gleaming opportunity that marries the old-world charm of gold with the sleekness of digital investment platforms. Enter Sovereign Gold Bonds (SGBs) on Groww, a beacon for those looking to sprinkle their portfolios with the sparkle of gold, minus the hassle of its physical possession. This quick guide is your gateway to navigating the golden avenues of investing in SGBs through Groww. Ready to infuse your investments with a touch of gold? Let’s get started on this seamless journey to owning digital gold.

Also Read: What are the New Ways to Verify Digital Payments Other than OTP?

Contents

How to Buy Sovereign Gold Bonds (SGBs) Online in Groww: A Step-by-Step Guide

Investing in Sovereign Gold Bonds (SGBs) through Groww is a seamless process that combines the safety of gold investment with the ease of online transactions. Here’s a step-by-step guide to help you buy SGBs online in Groww, understand the eligibility for investing, and highlight some key features and benefits of SGBs.

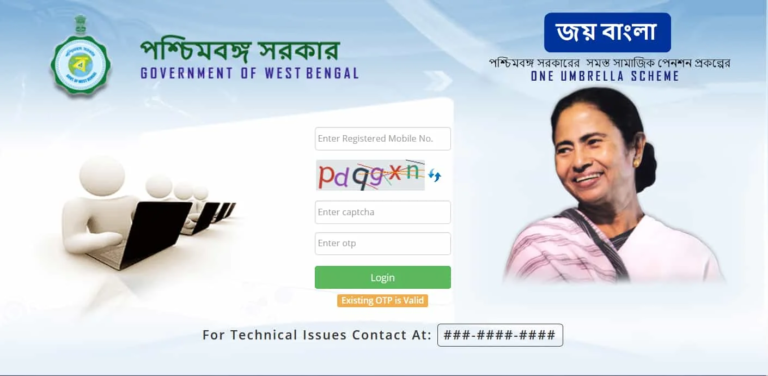

- Create or Log in to Your Groww Account: Start by logging into your Groww account. If you don’t have one, you’ll need to sign up and complete the KYC process, which is mandatory for investing.

- Navigate to the SGB Section: Once logged in, look for the section dedicated to Sovereign Gold Bonds. Groww offers an intuitive interface where you can find investment options categorized for ease of access. If there’s an ongoing SGB issue, it will be listed here.

- Select the Ongoing SGB Issue: Click on the specific SGB issue you are interested in. The details of the bond, including interest rate, maturity period, and issue price, will be displayed.

- Read the Bond Details Carefully: Before proceeding, ensure you understand all the terms and conditions associated with the bond. This includes the interest payout frequency, lock-in period, and tax implications.

- Choose the Investment Amount: Determine how many units of SGBs you wish to purchase. Remember, each unit represents one gram of gold. The minimum and maximum investment limits should guide your decision.

- Nominee Details (Optional): You can add nominee details for your investment at this stage. This is an optional step but recommended for ease of transfer in unforeseen circumstances.

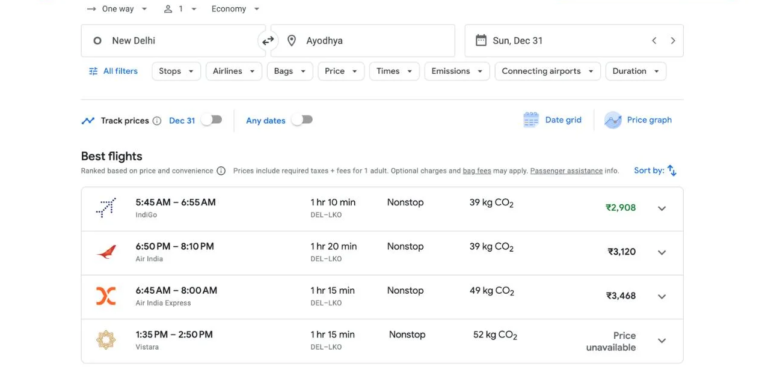

- Make the Payment: Proceed to payment. On Groww, you can pay via various methods such as net banking, UPI, or direct bank transfers. Ensure you have sufficient funds in your account for the transaction.

- Review and Confirm Your Purchase: Before finalizing your purchase, review all details of your transaction. Once satisfied, confirm your purchase.

- Receive Bond in Demat Form: After the purchase, the SGBs will be credited to your demat account. Groww or the RBI will notify you once the process is complete.

- Track Your Investment: You can monitor the performance of your SGB investment directly through your Groww account. Interest payments and any capital gains will be reflected in your account as per the schedule.

Who is Eligible to Invest in a Sovereign Gold Bond Scheme?

Eligibility for investing in SGBs is quite inclusive:

- Resident Individuals of India

- Hindu Undivided Families (HUFs)

- Minors (applications to be made by their guardian)

- Charitable Organisations, Trusts, and Universities

- Joint Holders

Non-resident Indians (NRIs), Overseas Citizens of India (OCIs), Persons of Indian Origin (PIOs), private limited companies, firms, and LLPs are not eligible to invest in SGBs.

Features and Benefits of SGB Investment

- Interest Income: SGBs offer a fixed interest rate of 2.5% per annum on the initial investment, paid out bi-annually.

- Tax Advantages: There’s no capital gains tax if the bonds are held until maturity. For premature redemption or sales in the secondary market, tax implications vary based on the holding period.

- Loan Collateral: SGBs can be used as collateral for loans in most banks, non-banking financial companies (NBFCs), and financial institutions.

- Nomination Facility: Investors have the option to nominate beneficiaries for their investment in SGBs.

- Investment Limits: The minimum investment is one gram of gold, with a maximum limit of 4 kg for individuals and HUFs, and 20 kg for trusts and other specified entities per financial year.