How to submit Digital Life Certificate (Jeevan Praman Patra) through doorstep banking

Hey there, dear readers! Imagine a world where pensioners can complete their annual life certificate submissions without the hassle of long queues or endless paperwork. Sounds like a dream, right? Well, dream no more because it’s now a reality, thanks to the Jeevan Pramaan initiative. We’re here to guide you through the whole process in a friendly, conversational tone.

We know you might have a bunch of questions swirling around in your mind. How do I register for this? Why is a digital life certificate even necessary? What if I don’t have an Aadhaar number? And a whole lot more. But worry not; we’ve got you covered! All those queries you have about Digital Life Certificates (DLC), we’re here to answer them in detail.

Contents

- 1 Jeevan Praman Patra: How to register for doorstep banking?

- 2 How to Request Doorstep Submission Process?

- 3 What is the purpose of a digital life certificate, and why is it required for pensioners?

- 4 Are there any specific age requirements for submitting life certificates?

- 5 What are the prerequisites for generating a Digital Life Certificate (DLC)?

- 6 Can I submit a life certificate if I don’t have an Aadhaar number?

- 7 Can I schedule a time for the Doorstep Banking service to collect my life certificate, and are there any restrictions on the timing?

- 8 How much are the service charges for Doorstep Banking, and are there any discounts for senior citizens?

- 9 Which accounts are eligible for Doorstep Banking services, and why are certain accounts excluded?

- 10 What happens if I miss the submission deadline for the life certificate?

- 11 How can I edit or update the address details for Doorstep Banking services?

Jeevan Praman Patra: How to register for doorstep banking?

Registering for Doorstep Banking services is a relatively straightforward process, and it can bring significant convenience to pensioners. Here’s a step-by-step guide on how to register:

- Download the Doorstep Banking App: You can download the Doorstep Banking app from the App Store for iOS devices or the Play Store for Android devices. Ensure that you have a compatible smartphone or tablet.

- Mobile Number Registration: After successfully downloading and installing the app, open it and register with your mobile number. This step is vital for communication and verification.

- OTP Verification: The system will generate a One-Time Password (OTP) that will be sent to the mobile number you provided during registration. Enter this OTP in the Doorstep Banking app to confirm your identity.

- Personal Information: After OTP verification, you will be prompted to provide your personal information. This includes your name and, optionally, your email address. You will also create a Personal Identification Number (PIN) for security purposes. Ensure that you accept the Terms and Conditions before proceeding.

- Logging In: Once you have successfully completed the registration and provided your personal information, you can log into the app using the PIN you created during registration.

- Adding Address Details: Inside the app, you can select the option to add and manage address details. This is crucial for Doorstep Banking services to know where to collect your life certificate. You can add, edit, or delete addresses as needed, ensuring the service provider has accurate information.

How to Request Doorstep Submission Process?

Requesting the Doorstep Submission Process for your Digital Life Certificate (DLC) is a straightforward procedure designed to bring ease and convenience to pensioners. Here’s a step-by-step guide:

- Contact Your Home Branch or Use Helpline: Start by reaching out to your home branch, which is usually the branch of your bank or financial institution where your pension account is managed. Alternatively, you can utilize the dedicated helpline for service requests by dialing 155299. The helpline is accessible to both customers of India Post Payments Bank (IPPB) and non-IPPB customers.

- Request a Service Slot: When contacting your home branch or using the helpline, you can request a service slot for the Doorstep Banking service. Here, you have the flexibility to pick a suitable time slot for the delivery of the service on your scheduled date.

- Timeline for Service Request: It’s essential to keep in mind the timeline for raising a service request. You can raise a request with a minimum lead time of T+2 days and a maximum lead time of T+10 days, as per the regulations of your bank.

- Scheduled Date and Time: Once your service request is confirmed, you’ll receive notification of the scheduled date and time for the Doorstep Banking service. Ensure you are available and prepared at the specified time to provide your life certificate and any required documentation.

What is the purpose of a digital life certificate, and why is it required for pensioners?

One of the most crucial aspects of this initiative is the requirement for pensioners to submit a digital life certificate. But what exactly is the purpose behind this certificate, and why is it necessary? The digital life certificate serves as proof that a pensioner is alive and eligible to continue receiving their pension benefits. It’s an essential document that ensures that only deserving pensioners receive their financial support.

Also Read: How to Use Face Authentication to Submit Super Senior’s Life Certificates

Are there any specific age requirements for submitting life certificates?

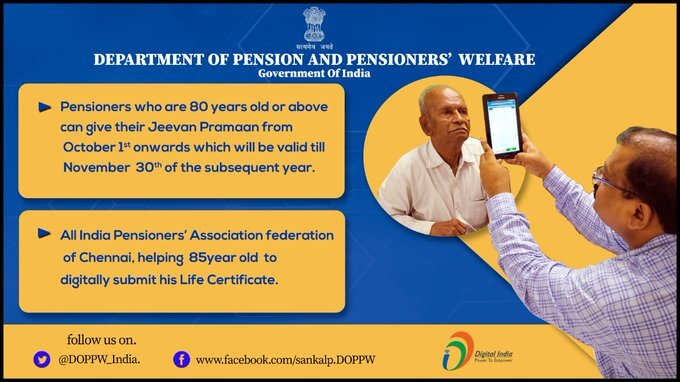

It’s vital to know whether there are specific age requirements for submitting life certificates through Jeevan Pramaan. The submission period depends on age, with those aged 80 and above having a different timeframe than those below 80. This accommodation is designed to make the process more manageable for pensioners and facilitate timely submissions.

- For pensioners aged 80 and above, the submission window is open from October 1 to November 30.

- For pensioners below the age of 80, the submission period is from November 1 to November 30.

What are the prerequisites for generating a Digital Life Certificate (DLC)?

To generate a Digital Life Certificate, you need to meet specific prerequisites, including:

- Having an Aadhaar number.

- Having a registered mobile number.

- Having your Aadhaar number registered with the Pension Disbursing Agency (e.g., a bank or post office).

- Using a supported biometric device (Iris or Fingerprint).

- Access to a PC with Windows 7.0 & above, or an Android Mobile/Tablet 4.0 & above.

- Internet connectivity.

Can I submit a life certificate if I don’t have an Aadhaar number?

The Aadhaar number is typically a prerequisite for generating a Digital Life Certificate. However, for specific cases where pensioners do not have an Aadhaar number, alternative verification methods may be available. It’s recommended to contact the relevant authorities for guidance in such situations.

Can I schedule a time for the Doorstep Banking service to collect my life certificate, and are there any restrictions on the timing?

Yes, you can schedule a time for the Doorstep Banking service to collect your life certificate. Typically, service slots are available between 11:00 AM to 4:00 PM on scheduled dates. The specific timing and availability may vary depending on the service provider and location.

How much are the service charges for Doorstep Banking, and are there any discounts for senior citizens?

The service charges for Doorstep Banking services usually amount to Rs 70 plus GST. However, these charges may vary depending on the bank or financial institution providing the service. Some banks may offer limited free Doorstep Banking services, especially for senior citizens.

Which accounts are eligible for Doorstep Banking services, and why are certain accounts excluded?

Not all accounts are eligible for Doorstep Banking services. Typically, accounts operated jointly, minor accounts, and accounts of a non-personal nature are excluded. The exclusion of these accounts aims to streamline the service for individual pensioners and ensure efficient and secure transactions.

What happens if I miss the submission deadline for the life certificate?

If you miss the submission deadline for your life certificate, it may have consequences for the continuation of your pension benefits. It’s crucial to promptly contact the relevant authorities, such as the Pension Disbursing Agency (e.g., the bank or post office), to understand the steps to rectify the situation.

How can I edit or update the address details for Doorstep Banking services?

You can typically update or edit your address details for Doorstep Banking services by accessing the Doorstep Banking app or portal. This allows you to keep your information current and ensures that the Doorstep Banking service knows where to collect your life certificate. It’s a simple yet vital step in ensuring the smooth operation of the service.