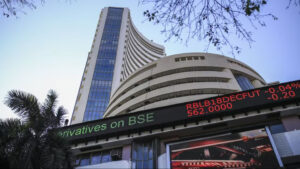

TRENDING NOW: Why BSE Share Price Falling / Down Today?

The Bombay Stock Exchange (BSE) Ltd., one of India’s premier stock exchanges, witnessed a significant tumble in its stock price, dropping by 18% on Monday. This marks the largest single-day decline since the company went public in 2017. The sharp fall in BSE’s stock price can be attributed to a new regulatory directive from the Securities and Exchange Board of India (SEBI), which has major implications for the exchange’s financial calculations and subsequent fees owed to the regulator.

Also Read: When Will EPF Interest Be Credited for FY 2023-24?

Contents

Regulatory Changes and Financial Impact

The crux of the issue lies in the method BSE used to calculate its annual turnover for the purpose of regulatory fees. Traditionally, BSE calculated this based on the premium value of its options contracts. However, SEBI has mandated that the turnover should be calculated based on the ‘notional value’ of these contracts, which is typically higher than the premium value.

As a result of this change, BSE is now required to pay a differential regulatory fee amounting to ₹165 crore for the period spanning from the financial year 2007 to 2024. Of this total, ₹69 crore covers the period up to 2023, and an additional ₹96 crore is attributed to the financial year 2024. This sudden financial obligation, coupled with the interest on the past due amount, has spooked investors, leading to a rapid sell-off in BSE’s shares.

Also Read: Can A Government Employee Invest In The Share Market?

Comparison with Industry Peers

BSE is not alone in facing such regulatory adjustments. Its industry peer, the Multi Commodity Exchange (MCX), has also been directed to pay a differential fee, although at a much smaller scale of ₹4.43 crore. The disparity in the fee amounts between BSE and MCX further highlights the significant impact of the new calculation method on BSE, given its larger volume of options trading.

Brokerage Perspectives and Market Reactions

The brokerage firm Jefferies has reacted to these developments by adjusting its outlook on BSE’s stock. Noting that derivatives, which are expected to contribute nearly 40% to BSE’s profits in the financial years 2025 and 2026, are directly affected by the increased fees, Jefferies predicts a 15% to 18% impact on BSE’s Earnings Per Share (EPS). Although Jefferies maintains that an increase in derivatives volume along with strategic price hikes and enhanced premium quality could potentially offset these impacts, it has nonetheless downgraded BSE’s stock from “buy” to “hold” and reduced its price target from ₹3,000 to ₹2,900.

Despite the severe drop, it’s noteworthy that BSE’s stock has performed exceptionally well over the past year, with an increase of over 400%. This long-term growth narrative might provide some solace to investors amid the current turbulence.

Market Outlook

Today’s downturn reflects a market adjusting to unexpected financial burdens imposed on BSE. While the long-term effects of this regulatory change are yet to be fully realized, BSE’s ability to manage these challenges through strategic pricing and volume growth will be crucial in determining its financial health and market position moving forward.

For investors, the situation underscores the importance of regulatory environments in shaping the financial pathways for major market players like BSE. As the market digests this information, the coming days will be critical in shaping investor sentiment and the stock’s recovery trajectory.